The latest Planet Money podcast–How Many Jobs Has Scott Walker Created?–was about whether government and politicians can actually create jobs. The Planet Money team focused on Wisconsin’s governor, Scott Walker, and rightly pointed out that his plan doesn’t seem to be creating jobs so much as allowing them to be created by local businesses. He’s mostly doing this via small tax incentives for companies who hire new employees (we’re talking like net $300 for the company for each new job created). They correctly concluded that this tiny amount of incentive has little to do with actually creating jobs–if a company is on the fence as to whether to hire new people, then a $300-per-person incentive might get them off the fence, but it’s only a useful incentive in marginal cases.

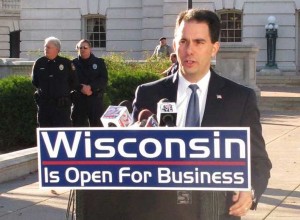

Wisconsin Is Open For Business

Then they moved on to Walker’s “Wisconsin Is Open For Business” slogan that he is using to try to entice companies to relocate to Wisconsin (image from here). Here are some excerpts I transcribed* from Chana Joffe-Walt‘s (CJW) interview with Scott Walker (SW):

CJW: Who specifically is going to be hiring because of your program?

SW: Catalyst Exhibits that was from Crystal Lake, Illinois… We gave them an incentive to come up to the state of Wisconsin. They get a two year reprieve from state income tax.

CJW: Is that creating jobs or is that just stealing jobs from some other state?

SW: …It’s moving jobs. We’re giving them an incentive to move to the state of Wisconsin.

CJW: You’re very aggressively promoting “Come to Wisconsin”, right? And that’s presumably jobs that would be created in other states nearby. So, there is some element of just taking them from other states and getting them for your state.

And here are some comments from Adam Davidson (AD):

AD: They focus a lot of attention on getting companies to move from some other state to their state.

AD: …that doesn’t make our national economy do better. That’s not adding jobs or creating new industries. It just moves the pieces around the chess board a little bit. And that doesn’t really make for an overall healthier economy.

AD: …there are ways to use the tax code to encourage short-term behavior for a small number of companies. But what the economists concluded was that really what government can do is long term. That’s where government has a shot at creating long-term job development.

So Chana and Adam are saying there’s no economic benefit (local or national) to incentivizing companies to relocate to Wisconsin. The problem is they’re assuming that “jobs” is a zero-sum game, and they’re conflating competition with thievery. (They’re also assuming the goal is full employment as opposed to full production, but that’s another subject for another time.)

The implication is that Wisconsin (via Scott Walker’s plan) would coerce or trick companies to move from their current state to Wisconsin because there isn’t actual benefit to them moving. Or maybe they’re saying there is a benefit, but only to the company itself and not to Wisconsin or to the economy (state or national). This is ridiculous.

Is there a benefit to the company?

What would it take for a company–let’s use a fake company called Novelty Oven Mitts (NOM) that sells novelty oven mitts (noms)–to uproot itself from its current state and move to Wisconsin? A two-year tax reprieve might help, but a viable company isn’t going to just up and move because “Two years with no tax?! That’s just too good to be true! Let’s go to Wisconsin, y’all!” They’re going to do a cost-benefit analysis that includes the two-year tax reprieve, but they’ll also look at the longer-term picture:

“Well, we’ll save $50,000 in taxes over two years if we move. But then we’ll be subject to Wisconsin’s normal tax system. How much will that cost or save us after the two years is up? What’s the cost of relocating this company? Will all of our employees move with us? How much will it cost to replace the employees who don’t move? How would that move affect our business? Would we lose customers? How many? What is each of those customers worth?”

Eventually, they’d have a ballpark range of numbers and they would use those numbers to make their decision to stay or move:

“We’ll save $50,000 in taxes the first two years, but it will cost us $10,000 more every year after that. And we’ll lose five employees who we’ll have to replace when we get up there. The cost just isn’t worth it. Thanks anyway, Wisconsin.”

Or

“We’ll save $50,000 in taxes the first two years, and we’ll save another $5,000 per year after that. We’ll lose two employees, but we think we can replace those easily in Wisconsin and it’ll cost about $10,000 to replace both of them. We’ll save money by moving to Wisconsin, and our customers don’t care where we knit their novelty oven mitts. Let’s go!”

So, if NOM decides to move from Illinois to Wisconsin, they must see some sort real benefit. But it’s possible that only NOM benefits from the move, and that neither the local Wisconsin economy nor the national economy benefit.

Are there national economic benefits when a company moves from state to state?

If NOM decides to move to Wisconsin, either they will save money and continue doing the same amount of business, or they’ll be able to operate cheaper and will therefore be able to do more business (assuming there is demand for their noms). In the first case, some of the savings will become profit, and some will be passed on to consumers as lower prices (consumer surplus). In the second case, more consumers will have access to NOM noms because they’ll be producing more noms with their newly found excess capital. NOM would either buy new equipment or hire new employees with the excess capital in order to boost production. Either way, consumers in the national economy benefit.**

Are there local economic benefits for Wisconsin when a company moves into the state?

It’s tough to say if Wisconsin’s economy will benefit from this program. Presumably, they would also have done a cost-benefit analysis to determine the benefit of offering a two-year tax reprieve for relocating companies:

“If we offer this two-year reprieve, it’ll cost us $50,000 in tax dollars. But we’ll have a new company in the state, hopefully they’ll hire some people and then when the two years is up, they’ll continue paying taxes at $25,000 a year. So after four years or so, we’ll be in the black with this deal.”

Of course, if Wisconsin continues to subsidize*** the new business (eg, by extending the reprieve), then the national economy would benefit at Wisconsin’s expense since NOM would be getting services paid for by other Wisconsin businesses and residents.

Is this stealing?

This is competition, not “stealing”. The states are competing for business, and Wisconsin is trying to undercut other states’ prices (of operating a business) to get more business. It’s good for the consumer and the national economy. And it’s probably good for Wisconsin’s economy in the long-run, too.

Notes:

* I transcribed this stuff manually, and I may have made mistakes. Most of the stuff I quoted comes from the 17:30 mark. As always, I encourage you to listen to the podcast for yourself.

** I’m making some assumptions here. Namely that if NOM moves to Wisconsin and is able to operate cheaper, but doesn’t translate some of this into consumer surplus (meaning they keep all the savings as profit), then another competitor will step in and undercut them to get a tasty piece of that profit pie. If no one else would do it, then at least we could count on Urban Outfitters to copy NOM’s noms and sell them cheaper.

*** I’m playing fast and loose with “subsidize” here. It’s technically not a subsidy because the government isn’t giving them money. But the government explicitly isn’t charging them money that it normally would. So it’s technically a tax incentive or tax break. Potato, potahto.